Harvey Danger, "Flagpole Sitta"

Footage is from Evil Dead II. Blood on the streets, indeed!

Winning at Zen, since March of 2007.

Footage is from Evil Dead II. Blood on the streets, indeed!

Posted by

Dinosaur Trader

at

8:46 PM

1 comments

![]()

Labels: music video

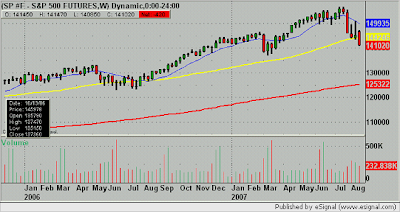

I figured it was a good idea to post that weekly graph of the futures. As you can see, we're just about where we were on January 1st, 2007.

It's a different story for the Dow. It's still up a few hundred points for the year.

Anyway, it was a wild day for stock trading yet again. With Hurricane Dean looming in the Caribbean and huge companies like CFC having serious trouble, this volatility shows no sign of ending. I'll say that at least in my mind, it feels like our entire financial system is about to collapse. So far, I don't think stocks have fully priced in that type of fear. I think it will take that type of fear induced capitulation plus some financial companies opening up their books and letting people know how deep the sub-slime is to hit some type of bottom... that, or some type of FED bailout in the form of a deep rate cut. But whatever, I'm a trader.

Here's my best stock of the day, UBB.

Ironically enough, I missed the short that melted the stock from 2pm into the close. I made my money on the long side, between 9:45 and 10:00. I actually think that's a really good thing because it tells me that I'm very open-minded about the market right now. I got crippled for a couple of months after the February panic because I could only see shorts. So I'm happy that while the tone of the market is overwhelmingly bearish right now I managed to pull good money from the long side.

At the same time that I caught the UBB long, I also made good money on corresponding longs in AB and CNS. It was all about the financials rallying at that point of the day due to some Fed action. Again, I'm not an economist so I really don't know what they did. But, I don't care. As a trader my job is to react to movement in the market, not to necessarily understand what's causing the movement.

In fact, often the more you know as a trader, the worse off you can be. Because when you know too much, you can start telling yourself stories. And when you start believing your stories you can get stuck in bad trades. The only story you pay attention to is the price and volume action.

Another thing I didn't understand was the movement in AMG today. And wow, my timing was also awful in this stock. Basically, it was spiking up and down a point at the time as you can see on the 5-minute graph below.

I really got sucked into him today and made bad trades over and over. All of them were on the short side. The stock was just choppy today and I shouldn't have been trading it. I think I was watching it because it's my best stock on the month. However, I need to remember that the past is gone forever. Just because I made money in him a week ago means nothing about my ability to make money in him today, or tomorrow.

Anyway, the futures are down a bit again overnight. FXY is trading $86... it doesn't look like we're close to going down just yet. However, I'd expect some type of little rally attempt soon.

Here's the stats:

P&L, $2509

Best, UBB, $1131

Worst, AMG, -$998

shares traded, 39,600

27 stocks traded, 20 winners, 7 losers

193 trades

Posted by

Dinosaur Trader

at

7:55 PM

0

comments

![]()

Labels: daily trading statistics, stock trading in general, stock trading rules

I'm not talking about NYSE "ticks", here, I'm referring to the tiny disease ridden parasites that thrive where I live.

This past weekend, I filled up my daughter's inflatable pool and placed it on the back patio. She was splashing around, talking about farm animals and puppets and generally having a blast.

That's when I noticed a small black dot under her right armpit.

"What's that under your armpit?"

Immediately, she scowled at me and tucked her arm tight against her body. Taking a look at the "black dot" let alone prying it off, would not be easy. She sensed trouble... "I want Mommy!"

Thus summoned, Judy came outside and in her sing-songy voice said, "Let me see what's under your arm, honey!" My daughter tersely replied, "No! You will not look under my arm!"

We stepped into the house. Extreme cajoling and perhaps force would be required here. I quietly closed all the windows.

In the next 45 minutes, the myth of the "tick fairy" was created. This particular fairy collects dead, blood swollen ticks and in return, gives little children gifts. What does she do with the dead ticks? She collects them in jars and juices them. This juice, in turn, powers her little fairy-mobile with which she delivers her presents.

While we improvised this rather disturbing story, my daughter looked at us with a face that more or less said, "Wow... that's completely messed up" but importantly, let us remove the tick.

The tick fairy brought her a little doll, that of course, was made in China.

NOTE: Daily post will be late.

Posted by

Dinosaur Trader

at

4:30 PM

3

comments

![]()

Labels: around the house

Me, $2509 on 39,600 shares traded.

HPT, $2100 on 109 contracts traded.

Evolution, $343 on 10,000 shares traded.

OBAT, $180 on 5800 shares traded.

Denarii, $32 on 1000 shares traded.

Bubs, -$342 on 2600 shares traded.

Despite the fact that Maria Bartiromo must have said 10 times today... I'm sorry, must have shrieked 10 times today that the "smart money is buying the market here" the market dropped almost 200 points. Ah, Maria...

But, perhaps it's true. We really don't know. I mean, I don't have friends in high places like Ms. Bartiromo does, but I do have stock software. What that software shows over and over again, is that this market sells off in high volume. When it goes up, it goes up in light volume. That's not a sign of strength.

I guess there are lots of idiots out there selling this great market.

Anyway, the VO continues to show strength... the majority of traders in the VO keeps making money in the face of all this volatility. It's a traders market to be sure. I certainly don't want too much overnight risk.

We'll see what tomorrow brings. The headline risk to this market is gigantic.

NOTE: My daily post will be late tonight. For now, I'll bump my first post of the day, "The Tick Fairy."

Posted by

Dinosaur Trader

at

3:52 PM

0

comments

![]()

Labels: CNBC stupidity, stock trading in general, virtual office

Katrina.

Dean.

I just did this comparison out of curiousity. I really want to go on vacation next week but I'm afraid oil is going to freak out. In the next few days this picture should become clearer.

Anything can happen at this point.

Posted by

Dinosaur Trader

at

1:19 PM

0

comments

![]()

Labels: stock trading in general

Funny.

We wake up today and hear that the FED is doing "repo action" or something like that. I'm not an economist... I don't know what they're doing.

But take a look at the futures! You see that spike up? That's when CNBC reports that the FED "cancelled their repo action."

Everyone thinks, YAY! The FED doesn't see the need for more liquidity, everything must be "okay!"

Ah... but what about that spike down? That's 5 minutes later when CNBC says that the FED cancelled the "repo action" because of "technical difficulties" and that they'll be doing it, but just a little later.

Makes for an exciting morning.

Posted by

Dinosaur Trader

at

10:06 AM

5

comments

![]()

Labels: Clarence "the rodent of stock market volatility", CNBC stupidity, stock trading in general